The United Arab Emirates (UAE) has established itself as a global business hub, largely due to its strategic geographical position and the creation of free trade zones (FTZs). A free trade zone in the UAE is a specially designated area where companies are exempt from several key financial restrictions. These zones are created to encourage international business and company formation in Dubai by offering a range of incentives that make the UAE an attractive destination for investors.

Some of the key benefits of operating in a UAE free trade zone include no income tax, 100% foreign ownership, and the absence of import and export restrictions. There are numerous free zones across the UAE, each designed to cater to specific industries and business types. This article will provide a comprehensive guide to free trade zones in the UAE, the benefits of establishing a company there, and the steps required to set up a business.

Content of Page

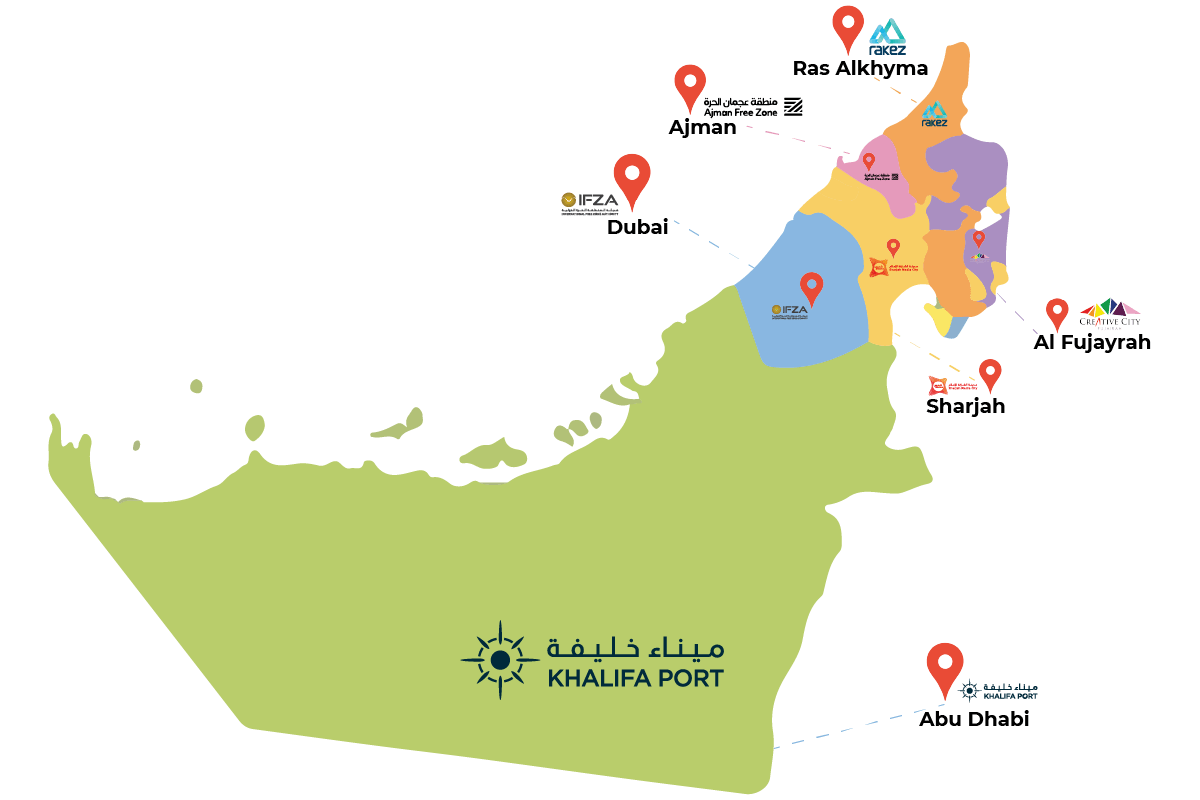

Key Free Trade Zones in the UAE

Each Emirate within the UAE has developed its own free trade zones, offering various advantages depending on the nature of your business. Here are some of the most prominent:

Jebel Ali Free Zone (JAFZA)

Located in Dubai, JAFZA is one of the oldest and most established free zones in the UAE, operating since 1985. It is home to thousands of international companies and offers a wide range of infrastructure and facilities, including access to one of the largest ports in the world, Jebel Ali Port. JAFZA caters primarily to industries such as logistics, manufacturing, and trade, with access to global shipping routes.

Hamriyah Free Zone (HFZA)

Located in the Emirate of Sharjah, Hamriyah is the second largest free zone in the UAE. It is particularly popular among companies involved in petrochemicals, steel, and construction industries due to its proximity to the sea and its industrial focus. HFZA offers highly competitive costs for warehousing and office space.

Ras Al Khaimah Economic Zone (RAKEZ)

Formed in 2017 by merging the Ras Al Khaimah Free Trade Zone and the Ras Al Khaimah Investment Authority, RAKEZ provides a cost-effective alternative to some of the more expensive free zones in the UAE. RAKEZ is known for its ease of doing business and has become a popular destination for startups and small to medium-sized enterprises (SMEs).

Benefits of Establishing a Company in a UAE Free Trade Zone

Free zones offer a wide range of benefits that make them an attractive option for businesses of all sizes and sectors. Some of the key advantages include:

Tax Exemptions

One of the primary reasons companies choose to operate in UAE free zones is the tax benefits. Most free zones offer exemptions from corporate income tax, which can greatly reduce the financial burden on businesses. Additionally, companies operating in free zones are typically exempt from import and export duties, further enhancing the profitability of businesses focused on trade.

100% Foreign Ownership

Unlike mainland companies, which require a local partner to own 51% of the business, free zone companies allow 100% foreign ownership. This ensures that international investors have full control over their businesses.

Simplified Registration and Licensing

The process of registering a company in a free zone is often streamlined and simplified. Free zone authorities have designed the process to be efficient, enabling businesses to set up quickly and start operations in a relatively short timeframe.

Duty-Free Trade

Many free zones provide duty-free access to markets, allowing companies to import goods without paying customs duties and then export to international markets. This is particularly advantageous for businesses involved in global trade.

Favorable Location

The UAE’s geographic location between Europe, Asia, and Africa makes it a global trading hub. Free zones leverage this position to offer businesses access to key markets, efficient shipping routes, and advanced infrastructure.

Real Estate Ownership

Companies operating in free zones can own real estate, including office buildings, warehouses, and other commercial properties, without the need for a local sponsor.

Resident Visas

Companies operating in free zones can apply for UAE resident visas for their owners and employees. The number of visas a company is eligible for depends on the size of the office or facility they lease within the free zone.

Steps to Set Up a Company in a UAE Free Trade Zone

Setting up a company in a UAE free trade zone is a straightforward process, though it varies slightly depending on the free zone and the type of business. Below are the general steps involved:

Choosing the Right Free Zone

The first step is to choose a free zone that aligns with your business needs. Some free zones cater specifically to certain industries (e.g., logistics, manufacturing, technology), while others offer more general business setups. It’s important to consider the location, available facilities, and any industry-specific advantages the free zone offers.

Selecting a Business Activity

When setting up a company, you must choose the specific business activities your company will engage in. The chosen free zone will provide a list of permitted activities, and your business can only operate within the scope of the activities listed on your trade license.

Applying for Initial Approval

Once you’ve chosen a free zone and determined your business activity, you’ll need to apply for initial approval from the free zone’s registration authority. This involves submitting details about the business and the owners.

Obtaining a Business License

After receiving initial approval, you will need to apply for a business license. The type of license (e.g., trading, manufacturing, service) will depend on the business activity. The business license allows you to legally operate your business within the designated free zone.

Opening a Corporate Bank Account

After your company is registered, you’ll need to open a corporate bank account in the UAE. This requires submitting your company’s registration documents, trade license, and other relevant paperwork to a bank.

Securing Office Space

Free zones typically require companies to lease or purchase office or warehouse space within the zone. The size of your office will also impact the number of resident visas you can apply for.

Document Submission and Legalization

Certain documents are required for company registration, including a business plan, passport copies of shareholders, signatures of directors, and financial statements. These documents must be legalized, translated into Arabic, and notarized.

Visas and Immigration

Once your company is set up, you can apply for resident visas for owners, employees, and dependents. You will also need to obtain an immigration card for your company to sponsor visas.

Challenges and Considerations

While free zones offer numerous benefits, there are some challenges and restrictions that businesses should be aware of:

Restrictions on Local Market Access:

Companies registered in a free zone are restricted from directly trading in the local UAE market unless they partner with a local distributor. For businesses looking to operate within the UAE’s domestic market, it may be necessary to explore other business models or legal structures.

Long Process for Document Legalization:

If you are managing the setup process remotely, document legalization can be time-consuming. Ensuring that all paperwork is properly translated, notarized, and submitted to relevant authorities can cause delays if not handled correctly.

Investment Calculation and Banking Relations:

Establishing a strong banking relationship in the UAE may take time, especially if you plan to seek financing or loans from local banks. Companies typically need to show three years of financial statements with accounting profits before they can access certain banking services.

Conclusion

Setting up a company in a UAE free trade zone offers numerous advantages, from tax exemptions to simplified business procedures and access to international markets. With more than 40 free zones across the UAE, each offering unique benefits, businesses of all types can find a suitable zone that aligns with their objectives. Whether you’re a startup or an established multinational corporation, the UAE’s free trade zones present a highly favorable environment for growth and expansion.

For businesses looking to maximize their investment in the UAE, free zones are an attractive option, offering both ease of setup and long-term operational benefits. However, it is crucial to conduct thorough research, choose the right free zone, and carefully navigate the legal and procedural requirements to ensure a smooth and successful company setup.